Guidance for completing an application for KiwiSaver first See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request

MERCER KIWISAER SCEME KIWISAVER RETIREMENT

Get my KiwiSaver funds for significant financial hardship. Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver., that poses a serious and imminent risk of death. For a serious illness withdrawal ask your medical practitioner to complete Section B Medical Practitioner's Declaration, followed by Section D Statutory Declaration. Before proceeding, please refer to the attached extract at the back of this application form titled KiwiSaver Act 2006, Schedule 1..

Application for withdrawal forms. Use these forms to apply to make a withdrawal from your Aon KiwiSaver Scheme account. Application for withdrawal forms Other forms. Other forms If you can't find the form that you're looking for, or that poses a serious and imminent risk of death. For a serious illness withdrawal ask your medical practitioner to complete Section B Medical Practitioner's Declaration, followed by Section D Statutory Declaration. Before proceeding, please refer to the attached extract at the back of this application form titled KiwiSaver Act 2006, Schedule 1.

Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver. • I have read the privacy information of this first or second-chance home withdrawal form. • I have never made a withdrawal from a KiwiSaver Scheme (whether this Scheme or any scheme to which I previously belonged) for a first or second-chance home withdrawal before. • I have been a member of a KiwiSaver Scheme for three years or more.

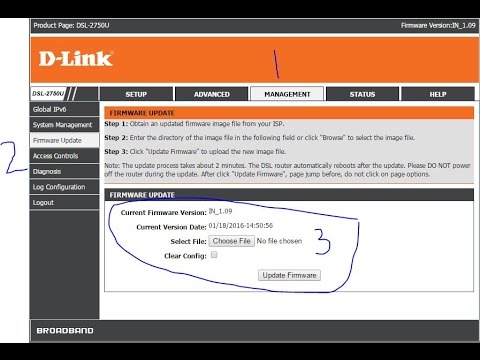

KiwiSaver retirement withdrawal. Last updated: 25/09/2019 03.19 PM. of funds transferred from an Australian complying superannuation fund you'll need to complete the Retirement Withdrawal Application Form (Australian sourced funds only) (PDF 48kB) and return it with your appropriate identification. If you've been a member of KiwiSaver for at least three years you may be able to use your savings to help you buy your first property in New Zealand - that property can be either (i) bare land on which you intent to build your home or (ii) and existing home and land.

Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Use this form to apply for a refund of KiwiSaver contributions held by Inland Revenue if you are: • experiencing serious illness, or • experiencing, or likely to experience, significant financial hardship 1-10-2019 · KiwiSaver withdrawals before you turn 65. You can withdraw some or all of your money from KiwiSaver before you turn 65 if you’re buying your first home, moving overseas permanently, develop an illness or suffer serious financial hardship.

Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver. Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Use this form to apply for a refund of KiwiSaver contributions held by Inland Revenue if you are: • experiencing serious illness, or • experiencing, or likely to experience, significant financial hardship

Application for withdrawal forms. Use these forms to apply to make a withdrawal from your Aon KiwiSaver Scheme account. Application for withdrawal forms Other forms. Other forms If you can't find the form that you're looking for, or Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver.

1-10-2019 · KiwiSaver withdrawals before you turn 65. You can withdraw some or all of your money from KiwiSaver before you turn 65 if you’re buying your first home, moving overseas permanently, develop an illness or suffer serious financial hardship. 9-9-2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you.

See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account.

25-7-2019 · The criteria for withdrawing your savings depends on your age and the date you joined KiwiSaver. KiwiSaver withdrawals after you turn 65. If you’re living overseas and make a withdrawal from your KiwiSaver account, you may have to pay tax in the country you’re living in. Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier.

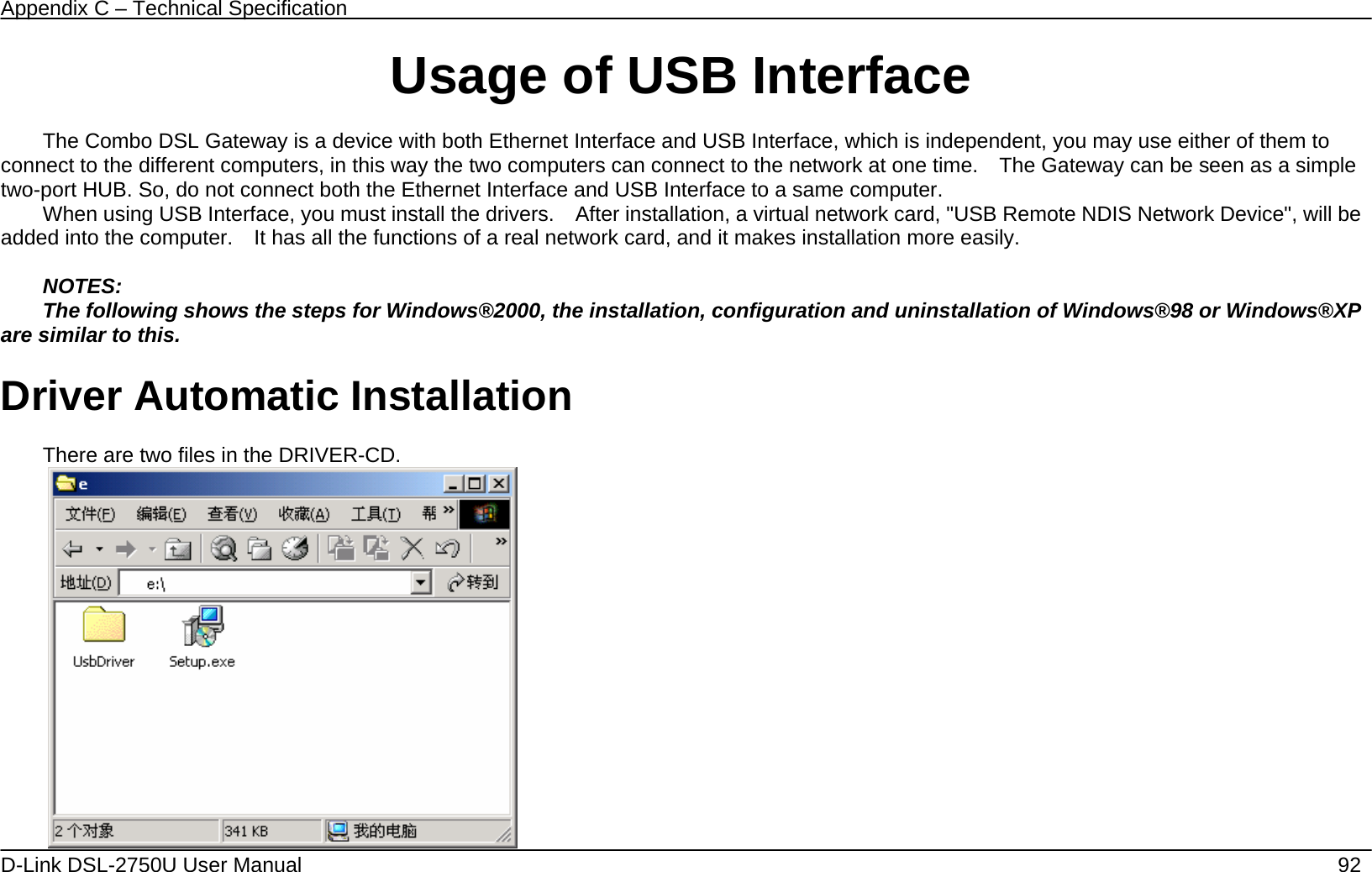

MERCER KIWISAER SCEME KIWISAVER RETIREMENT WITHDRAWAL— APPLICATION FORM Issed Mercer N Limited as manaer of the Scheme Please print in black or blue pen, in uppercase, one character per box and all that apply. that poses a serious and imminent risk of death. For a serious illness withdrawal ask your medical practitioner to complete Section B Medical Practitioner's Declaration, followed by Section D Statutory Declaration. Before proceeding, please refer to the attached extract at the back of this application form titled KiwiSaver Act 2006, Schedule 1.

Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver. 1-10-2019 · KiwiSaver withdrawals before you turn 65. You can withdraw some or all of your money from KiwiSaver before you turn 65 if you’re buying your first home, moving overseas permanently, develop an illness or suffer serious financial hardship.

Guidance for completing an application for KiwiSaver first. Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier., Application for withdrawal of initial KiwiSaver contribution KS5 (PDF 109KB) Download form Send the form to us. Inland Revenue PO Box 39090 Wellington Mail Centre Lower Hutt 5045. What happens next We'll review your application and let you know the outcome. If we approve it, we’ll send you a confirmation letter and make a refund to your bank.

KiwiSaver withdrawals after you turn 65 NZ Government

MERCER KIWISAER SCEME KIWISAVER RETIREMENT. If you've been a member of KiwiSaver for at least three years you may be able to use your savings to help you buy your first property in New Zealand - that property can be either (i) bare land on which you intent to build your home or (ii) and existing home and land., MERCER KIWISAER SCEME KIWISAVER RETIREMENT WITHDRAWAL— APPLICATION FORM Issed Mercer N Limited as manaer of the Scheme Please print in black or blue pen, in uppercase, one character per box and all that apply..

APPLICATION FORM FOR FIRST OR SECOND-CHANCE HOME

Application for Withdrawal – Purchase First Home. If you've been a member of KiwiSaver for at least three years you may be able to use your savings to help you buy your first property in New Zealand - that property can be either (i) bare land on which you intent to build your home or (ii) and existing home and land. https://en.wikipedia.org/wiki/Registered_Retirement_Savings_Plan I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account..

that poses a serious and imminent risk of death. For a serious illness withdrawal ask your medical practitioner to complete Section B Medical Practitioner's Declaration, followed by Section D Statutory Declaration. Before proceeding, please refer to the attached extract at the back of this application form titled KiwiSaver Act 2006, Schedule 1. that poses a serious and imminent risk of death. For a serious illness withdrawal ask your medical practitioner to complete Section B Medical Practitioner's Declaration, followed by Section D Statutory Declaration. Before proceeding, please refer to the attached extract at the back of this application form titled KiwiSaver Act 2006, Schedule 1.

Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Use this form to apply for a refund of KiwiSaver contributions held by Inland Revenue if you are: • experiencing serious illness, or • experiencing, or likely to experience, significant financial hardship Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver.

Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver. Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier.

Every year, KiwiSaver providers get a flurry of “hardship” withdrawal requests. In fact, between June 2008 and June 2017, 15,000 KiwiSaver members have withdrawn a combined total of $70 billion from their KiwiSaver accounts. And, in August 2017 alone, 1620 KiwiSaver members withdrew a combined total of $8.2 million for financial hardship! Summer KiwiSaver scheme 0800 11 55 66 summer.co.nz Application for withdrawal from the Summer KiwiSaver scheme on the grounds of significant financial hardship

Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier. See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request

Serious Illness Withdrawal Form Statutory Declaration the KiwiSaver Act 2006 requires that you must make a Statutory Declaration for your early withdrawal. I, the above named Applicant, do solemnly and sincerely declare that: I have had my principal residence in New Zealand for the entire period that I have been a member of KiwiSaver. MERCER KIWISAER SCEME KIWISAVER RETIREMENT WITHDRAWAL— APPLICATION FORM Issed Mercer N Limited as manaer of the Scheme Please print in black or blue pen, in uppercase, one character per box and all that apply.

Application for withdrawal forms. Use these forms to apply to make a withdrawal from your Aon KiwiSaver Scheme account. Application for withdrawal forms Other forms. Other forms If you can't find the form that you're looking for, or 1 Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Inland Revenue can only consider your application within the first three months of receiving your first contribution.

25-7-2019 · The criteria for withdrawing your savings depends on your age and the date you joined KiwiSaver. KiwiSaver withdrawals after you turn 65. If you’re living overseas and make a withdrawal from your KiwiSaver account, you may have to pay tax in the country you’re living in. If you've been a member of KiwiSaver for at least three years you may be able to use your savings to help you buy your first property in New Zealand - that property can be either (i) bare land on which you intent to build your home or (ii) and existing home and land.

• I have read the privacy information of this first or second-chance home withdrawal form. • I have never made a withdrawal from a KiwiSaver Scheme (whether this Scheme or any scheme to which I previously belonged) for a first or second-chance home withdrawal before. • I have been a member of a KiwiSaver Scheme for three years or more. Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Use this form to apply for a refund of KiwiSaver contributions held by Inland Revenue if you are: • experiencing serious illness, or • experiencing, or likely to experience, significant financial hardship

I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account. 9-9-2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you.

Application for withdrawal of initial KiwiSaver contribution KS5 (PDF 109KB) Download form Send the form to us. Inland Revenue PO Box 39090 Wellington Mail Centre Lower Hutt 5045. What happens next We'll review your application and let you know the outcome. If we approve it, we’ll send you a confirmation letter and make a refund to your bank I wish to make a withdrawal from my NZ Funds KiwiSaver Scheme account as below: First home withdrawal (this applies if you’ve never previously owned a property, other than a leasehold estate - whether alone or jointly with another person). First home withdrawal for a previous property owner (this applies if you’ve previously owned a property).

MERCER KIWISAER SCEME KIWISAVER RETIREMENT

Serious Illness Withdrawal Form Fisher Funds. • I have read the privacy information of this first or second-chance home withdrawal form. • I have never made a withdrawal from a KiwiSaver Scheme (whether this Scheme or any scheme to which I previously belonged) for a first or second-chance home withdrawal before. • I have been a member of a KiwiSaver Scheme for three years or more., If you’re seriously ill, are injured or become disabled and can no longer work, you can apply to withdraw all of your KiwiSaver savings. You’ll need to supply medical evidence to support your application. Please call us on 0800 ASB RETIRE (0800 272 738) to talk to us about your circumstances and the withdrawal ….

Serious Illness Withdrawal Form

Guidance for completing an application for KiwiSaver first. • I have read the privacy information of this first or second-chance home withdrawal form. • I have never made a withdrawal from a KiwiSaver Scheme (whether this Scheme or any scheme to which I previously belonged) for a first or second-chance home withdrawal before. • I have been a member of a KiwiSaver Scheme for three years or more., MERCER KIWISAER SCEME KIWISAVER RETIREMENT WITHDRAWAL— APPLICATION FORM Issed Mercer N Limited as manaer of the Scheme Please print in black or blue pen, in uppercase, one character per box and all that apply..

9-9-2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you. KiwiSaver withdrawal. 2.2 Amount of withdrawal If my application is approved please pay: a withdrawal of my full available balance (less $1,000 and transferred Australian savings). a partial withdrawal of $ deducted proportionately from each fund I invest in. 3.

9-9-2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you. See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request

I wish to make a withdrawal from my NZ Funds KiwiSaver Scheme account as below: First home withdrawal (this applies if you’ve never previously owned a property, other than a leasehold estate - whether alone or jointly with another person). First home withdrawal for a previous property owner (this applies if you’ve previously owned a property). KiwiSaver withdrawal. 2.2 Amount of withdrawal If my application is approved please pay: a withdrawal of my full available balance (less $1,000 and transferred Australian savings). a partial withdrawal of $ deducted proportionately from each fund I invest in. 3.

Summer KiwiSaver scheme 0800 11 55 66 summer.co.nz Application for withdrawal from the Summer KiwiSaver scheme on the grounds of significant financial hardship KiwiSaver Scheme for at least three years, not have already made a first home withdrawal from this or another KiwiSaver Scheme and the property you wish to purchase is intended to be your principal place of residence. The withdrawal is subject to approval and a minimum balance of $1,000 must be maintained in your Member’s account after

I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account. If you’re seriously ill, are injured or become disabled and can no longer work, you can apply to withdraw all of your KiwiSaver savings. You’ll need to supply medical evidence to support your application. Please call us on 0800 ASB RETIRE (0800 272 738) to talk to us about your circumstances and the withdrawal …

Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier. KiwiSaver retirement withdrawal. Last updated: 25/09/2019 03.19 PM. of funds transferred from an Australian complying superannuation fund you'll need to complete the Retirement Withdrawal Application Form (Australian sourced funds only) (PDF 48kB) and return it with your appropriate identification.

25-7-2019 · The criteria for withdrawing your savings depends on your age and the date you joined KiwiSaver. KiwiSaver withdrawals after you turn 65. If you’re living overseas and make a withdrawal from your KiwiSaver account, you may have to pay tax in the country you’re living in. Nau mai, haere mai. On 1 October, Housing New Zealand, HLC and KiwiBuild together became Kāinga Ora – Homes and Communities. The information on this website is …

KiwiSaver Scheme for at least three years, not have already made a first home withdrawal from this or another KiwiSaver Scheme and the property you wish to purchase is intended to be your principal place of residence. The withdrawal is subject to approval and a minimum balance of $1,000 must be maintained in your Member’s account after 1-10-2019 · KiwiSaver withdrawals before you turn 65. You can withdraw some or all of your money from KiwiSaver before you turn 65 if you’re buying your first home, moving overseas permanently, develop an illness or suffer serious financial hardship.

If you’re seriously ill, are injured or become disabled and can no longer work, you can apply to withdraw all of your KiwiSaver savings. You’ll need to supply medical evidence to support your application. Please call us on 0800 ASB RETIRE (0800 272 738) to talk to us about your circumstances and the withdrawal … I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account.

I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account. 1 Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Inland Revenue can only consider your application within the first three months of receiving your first contribution.

Lifestages KiwiSaver Scheme Significant Financial Hardship

KiwiSaver Here’s what you need to do. If you’re seriously ill, are injured or become disabled and can no longer work, you can apply to withdraw all of your KiwiSaver savings. You’ll need to supply medical evidence to support your application. Please call us on 0800 ASB RETIRE (0800 272 738) to talk to us about your circumstances and the withdrawal …, Application for withdrawal of initial KiwiSaver contribution KS5 (PDF 109KB) Download form Send the form to us. Inland Revenue PO Box 39090 Wellington Mail Centre Lower Hutt 5045. What happens next We'll review your application and let you know the outcome. If we approve it, we’ll send you a confirmation letter and make a refund to your bank.

KiwiSaver Withdrawal How To Apply For a Financial

Get my KiwiSaver funds for significant financial hardship. MERCER KIWISAER SCEME KIWISAVER RETIREMENT WITHDRAWAL— APPLICATION FORM Issed Mercer N Limited as manaer of the Scheme Please print in black or blue pen, in uppercase, one character per box and all that apply. https://en.wikipedia.org/wiki/Registered_Retirement_Savings_Plan Every year, KiwiSaver providers get a flurry of “hardship” withdrawal requests. In fact, between June 2008 and June 2017, 15,000 KiwiSaver members have withdrawn a combined total of $70 billion from their KiwiSaver accounts. And, in August 2017 alone, 1620 KiwiSaver members withdrew a combined total of $8.2 million for financial hardship!.

I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account. Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier.

Every year, KiwiSaver providers get a flurry of “hardship” withdrawal requests. In fact, between June 2008 and June 2017, 15,000 KiwiSaver members have withdrawn a combined total of $70 billion from their KiwiSaver accounts. And, in August 2017 alone, 1620 KiwiSaver members withdrew a combined total of $8.2 million for financial hardship! • I have read the privacy information of this first or second-chance home withdrawal form. • I have never made a withdrawal from a KiwiSaver Scheme (whether this Scheme or any scheme to which I previously belonged) for a first or second-chance home withdrawal before. • I have been a member of a KiwiSaver Scheme for three years or more.

KiwiSaver Scheme for at least three years, not have already made a first home withdrawal from this or another KiwiSaver Scheme and the property you wish to purchase is intended to be your principal place of residence. The withdrawal is subject to approval and a minimum balance of $1,000 must be maintained in your Member’s account after I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account.

See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request If you’re seriously ill, are injured or become disabled and can no longer work, you can apply to withdraw all of your KiwiSaver savings. You’ll need to supply medical evidence to support your application. Please call us on 0800 ASB RETIRE (0800 272 738) to talk to us about your circumstances and the withdrawal …

If you've been a member of KiwiSaver for at least three years you may be able to use your savings to help you buy your first property in New Zealand - that property can be either (i) bare land on which you intent to build your home or (ii) and existing home and land. 1-10-2019 · KiwiSaver withdrawals before you turn 65. You can withdraw some or all of your money from KiwiSaver before you turn 65 if you’re buying your first home, moving overseas permanently, develop an illness or suffer serious financial hardship.

If you’re seriously ill, are injured or become disabled and can no longer work, you can apply to withdraw all of your KiwiSaver savings. You’ll need to supply medical evidence to support your application. Please call us on 0800 ASB RETIRE (0800 272 738) to talk to us about your circumstances and the withdrawal … Summer KiwiSaver scheme 0800 11 55 66 summer.co.nz Application for withdrawal from the Summer KiwiSaver scheme on the grounds of significant financial hardship

MERCER KIWISAER SCEME KIWISAVER RETIREMENT WITHDRAWAL— APPLICATION FORM Issed Mercer N Limited as manaer of the Scheme Please print in black or blue pen, in uppercase, one character per box and all that apply. Application for withdrawal forms. Use these forms to apply to make a withdrawal from your Aon KiwiSaver Scheme account. Application for withdrawal forms Other forms. Other forms If you can't find the form that you're looking for, or

I understand that acceptance of this application is at the discretion of the Supervisor. I understand that on full payment of my KiwiSaver account, my account will be closed and I agree to release all claims that have been made by me on the Manager and/or Supervisor in relation to my KiwiSaver account. Summer KiwiSaver scheme 0800 11 55 66 summer.co.nz Application for withdrawal from the Summer KiwiSaver scheme on the grounds of significant financial hardship

• I have read the privacy information of this first or second-chance home withdrawal form. • I have never made a withdrawal from a KiwiSaver Scheme (whether this Scheme or any scheme to which I previously belonged) for a first or second-chance home withdrawal before. • I have been a member of a KiwiSaver Scheme for three years or more. Summer KiwiSaver scheme 0800 11 55 66 summer.co.nz Application for withdrawal from the Summer KiwiSaver scheme on the grounds of significant financial hardship

1-10-2019 · KiwiSaver withdrawals before you turn 65. You can withdraw some or all of your money from KiwiSaver before you turn 65 if you’re buying your first home, moving overseas permanently, develop an illness or suffer serious financial hardship. Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier.

Application for withdrawal of initial KiwiSaver contribution on the grounds of significant financial hardship or serious illness Use this form to apply for a refund of KiwiSaver contributions held by Inland Revenue if you are: • experiencing serious illness, or • experiencing, or likely to experience, significant financial hardship Lifestages KiwiSaver Scheme Significant Financial Hardship Withdrawal Application A significant financial hardship (hardship) withdrawal can help during times of financial difficulty. However, the purpose of your KiwiSaver savings is for your retirement so you will have to meet strict criteria to be eligible to withdrawal any of your funds earlier.